- Tech Mahindra share price

- ₹1232.62.26%

- Mahindra & Mahindra share price

- ₹15302.03%

- Tata Motors share price

- ₹6181.78%

- Tata Steel share price

- ₹118.950.72%

- Titan Company share price

- ₹2933.450.43%

- Tata Steel share price

- ₹118.950.72%

- Bharat Electronics share price

- ₹131.51.78%

- Coal India share price

- ₹232.951.17%

- Adani Power share price

- ₹278.75-0.54%

- Tata Motors share price

- ₹6181.78%

Silver Rates Today in India

Updated on 09 Aug, 202310g Silver Price

100g Silver Price

1Kg Silver Price

Apart from industrial use, silver also finds usage in the jewellery sector. India is the world's biggest silver consumer and also a major importer of the precious metal. In other words, the demand for the precious metal also helps in supporting global prices. Besides import duties and other taxes, international prices also play a big role in determining domestic silver rates. Like gold, silver also is seen as an investment avenue. Here are latest silver prices in major Indian cities.

Bangalore

Per 10 gram ₹705.30 -6.95Chennai

Per 10 gram ₹705.30 -6.95Delhi

Per 10 gram ₹705.30 -6.95Kolkata

Per 10 gram ₹705.30 -6.95Mumbai

Per 10 gram ₹705.30 -6.95Pune

Per 10 gram ₹705.30 -6.95

Find Silver price in your region

Silver News

Gold prices recover on cooling US labour market. Should you buy?

2 min read .10:38 AM ISTGold to retain its sheen in August, Silver likely to outperform this month

3 min read .14:05 PM ISTGold rate today under pressure as US dollar index climbs to three week high. Opportunity to buy?

1 min read .10:37 AM ISTNoise ColorFit Thrive with Bluetooth calling launched at ₹1,299: Details

1 min read .15:17 PM ISTSilver Rate in Different Cities in India

City Name

10g Price

100g Price

1Kg Price

- Ahmedabad

- ₹705.30

- ₹7053.00

- ₹70530.00

- Bangalore

- ₹705.30

- ₹7053.00

- ₹70530.00

- Bhubaneswar

- ₹705.30

- ₹7053.00

- ₹70530.00

- Chandigarh

- ₹705.30

- ₹7053.00

- ₹70530.00

- Chennai

- ₹705.30

- ₹7053.00

- ₹70530.00

- Coimbatore

- ₹705.30

- ₹7053.00

- ₹70530.00

- Delhi

- ₹705.30

- ₹7053.00

- ₹70530.00

- Hyderabad

- ₹705.30

- ₹7053.00

- ₹70530.00

- Jaipur

- ₹705.30

- ₹7053.00

- ₹70530.00

- Kerala

- ₹705.30

- ₹7053.00

- ₹70530.00

- Kolkata

- ₹705.30

- ₹7053.00

- ₹70530.00

Silver Rate for Last 15 Days

Dates

10g Price

1kg Price

- Aug 08, 2023

- ₹712.25

- ₹71225.00 -1055.00

- Aug 07, 2023

- ₹722.80

- ₹72280.00 -32.00

- Aug 06, 2023

- ₹723.12

- ₹72312.00 0.00

- Aug 05, 2023

- ₹723.12

- ₹72312.00 -384.00

- Aug 04, 2023

- ₹726.96

- ₹72696.00 0.00

- Aug 03, 2023

- ₹726.96

- ₹72696.00 -1403.00

- Aug 02, 2023

- ₹740.99

- ₹74099.00 -1231.00

- Aug 01, 2023

- ₹753.30

- ₹75330.00 1290.00

- July 31, 2023

- ₹740.40

- ₹74040.00 287.00

- July 30, 2023

- ₹737.53

- ₹73753.00 0.00

- July 29, 2023

- ₹737.53

- ₹73753.00 0.00

- July 28, 2023

- ₹737.53

- ₹73753.00 -2047.00

- July 27, 2023

- ₹758.00

- ₹75800.00 1072.00

- July 26, 2023

- ₹747.28

- ₹74728.00 349.00

Silver as an asset

‘All that glitters is not gold’, sometimes it is silver. Silver is a beautiful precious white metal, one in the class of gold, platinum, and palladium. Silver has always been in demand because of its unique characteristics and relative scarcity.

Beyond the ornamental value, silver has been used as a coinage metal since the times of the Greeks; their silver drachmas were popular trade coins. The ancient Persians used silver coins between 612–330 BC. Before 1797, British pennies were made of silver.

In India, it was the Indus Valley Civilisation that started the usage of silver mainly in the ornaments such as hair beads, necklace etc. Though it was also hammered to form thin sheets which could have been used to garnish eatables such as sweets. Across the period of India’s recorded history, silver just like gold has been a sacred metal with its varied usage in deity worship, rites and rituals and, as an insignia of wealth and prosperity.

Seventeenth-century Italian adventurer and traveler Giovanni Francesco Gemelli Careri once wrote, “India was the final destination for all the gold and silver that got exchanged through trade all over the world. The gold and silver amassed by the Europeans from the American continent reached Turkey and Persia and finally from there to Hindustan."

Factors impacting price of silver:

It is important to carefully examine a variety of various aspects in order to understand the pricing trends of silver. The analysis of silver pricing is complicated as some of the market phenomena that impact the price of silver interact inversely with one another.

A number of factors impact the price of silver ranging from macroeconomic adjustments in the bullion market to seasonal microeconomic demand for the metal. Here are a few factors that determine the price of silver in the market.

1. Supply and demand

2. Industrial and technical factors

3. Import and exchange rate

4. Government policies

5. Gold-silver ratio

Silver bullion:

Silver bullions include small silver bars, large silver bars and coins minted by government and private refineries. Silver bullion rounds are similar to coins but are produced by private mints and are not legal tender.

Some investors purchase silver bullion to diversify their holdings or to act as a hedge against inflation. Others gather silver bullion as a store of wealth or for its aesthetic value.

Silver Hallmarking:

Hallmarking is the accurate determination and recording of the content of precious metals in metals like gold, platinum and silver. Thus, hallmarked metals are guarantee of metals being pure and fine.

According to the BIS website, there are two principle objectives of the hallmarking scheme:

1. To protect the buyer against adulteration

2. To obligate the producer to maintain legal standards of fineness and purity.

BIS launched the hallmarking scheme for silver in the year 2005. A lot of silver dealers have since then been issued with hallmark licenses for selling hallmarked silver artifacts and jewelry.

In order to determine the purity of silver, hallmarking technique has been rolled out by the BIS, Bureau of Indian Standards, which is the organization responsible for Standardization, Certification and Quality.

BIS was launched as a statutory organization under the Bureau of Indian Standards Act, 1986.

In order to be certain that you are buying pure form of silver, there are a few signs that one should look for in the piece of jewelry or article to determine is authenticity-

1. BIS mark- BIS Mark is one of the foremost marks of purity of silver. It is a sort of triangular symbol with a dot inside the triangle. This is the official logo of Bureau of Indian Standards or BIS.

2. Purity grade: For fine silver, the purity grade is either of 999.9, 999.5 or just 999 For silver alloys, jewelry and artifacts, it is 970, 925, 900, 835, 800

3. Year of making: This is denoted by the letter J for the year 2008

4. Jeweler's identification mark: Jeweler’s identification mark is yet another technique to verify the purity of the metal.

How can you test the purity of silver?

Silver investors are greatly concerned about the purity of the metal since it has a huge bearing on the price on the metal. Out of many there are 3 ways to determine the purity of silver-

1. Silver testing kit: There are many jewellery stores and online retailers that sell silver testing kits. In order to use a silver testing kit, you must first clean the silver object and then dab it lightly with the testing solution. Silver and the solution will react, and the colour of the solution will show how pure the silver is.

2. Acid test: Apply a tiny drop of the suitable acid to the silver object, and then watch to see what colour the reaction takes. The purity of the silver will be revealed by the colour of the reaction.

3. Professional appraisal: Using more accurate and precise techniques, such as spectroscopy or x-ray fluorescence, a professional will be able to ascertain the silver's purity.

FAQs about Silver

What are the factors that impact the price of silver?

It is important to carefully examine a variety of various aspects in order to understand the pricing trends of silver. The analysis of silver pricing is complicated as some of the market phenomena that impact the price of silver interact inversely with one another.

A number of factors impact the price of silver ranging from macroeconomic adjustments in the bullion market to seasonal microeconomic demand for the metal. Here are a few factors that determine the price of silver in the market.

1. Supply and demand

2. Industrial and technical factors

3. Import and exchange rate

4. Government policies

5. Gold-silver ratio

Supply and demand: The supply of silver is not constant as in its natural form silver is a scarce commodity, with just a few nations having generous reserves. This means we have to manage with the current quantity of the commodity out there in the market.

Prices can change sharply if the demand and supply equation changes and are always an important factor when it comes to determining the rate of the metal.

Industrial and technical factors: Unlike gold, more than 50% of demand for silver comes from industrial applications. Silver is widely used in mirrors, integrated circuits of computers, solar cells, photographic films, etc.

The diversity of use of silver impacts the price of silver as newer technology that can substitute silver pulls down the demand while expansion of production of existing commodities enhances the demand. This change in demand pattern impacts the price of silver globally.

Import and exchange rate: A substantial part of silver used in India is imported, making import duties an important factor in determining silver prices in the country.

Silver rates are heavily dependent on how the US dollar performs since it is one of the commodities used for hedging. Any changes within the United States are bound to have an effect on silver prices, either directly or indirectly.

Government policies: Government’s policies on trade of silver have a significant bearing on the price of the metal. The taxes levied and the tariffs awarded for trading in silver determine the spot price of silver which in turn has an impact on the products made using silver.

Gold-silver ratio: There is a long-standing correlation between the prices of gold and silver, even if the true relevance of the gold-silver ratio is hotly contested. In general, silver prices will rise or fall in tandem with the price of gold. Some experts base their trading decisions on the GSR, buying or selling when silver is expensive or inexpensive in comparison to the current price of gold.

The quantity of silver needed to buy one ounce of gold is known as the gold-to-silver ratio. Since it demonstrates that silver is fairly affordable relative to the ratio when it is high, many investors interpret this to suggest that silver is favored. On the other hand, a low ratio favors gold and may indicate that it is a good time to purchase the yellow metal. As the ratio falls, a lot of large-scale, knowledgeable investors could exchange their silver for gold. When this ratio reaches a peak above 80, it is considered as one of the finest "buy" signs for silver.

What is the demand and supply scenario of silver in India?

India is one of the largest markets for silver in the world, and it depends largely on imports to meet its demands. Over 50% of domestic silver demand is made up of the manufacturing of jewelry and silverware. In 2016, India consumed 160.6 million ounces (4,996 tonnes), which was a significant 16% of the world's silver demand.

How can you get silver insured in India?

You can insure your silver jewellery, coins, and other valuables in India against theft, loss, or damage. You can get insurance for your silver by speaking with an insurance provider and finding out about their options for covering valuable metals.

How are silver assets taxed in India?

Depending on how the silver is held, investments in silver are taxed differently in India. You won't pay capital gains tax when you sell silver that you own in the form of physical objects like silver jewellery, coins, or bars. But if you make money off the sale of the silver, it might be subject to income tax, depending on how much money you made and your tax bracket.

You might be required to pay capital gains tax on your profits when you sell financial instruments you hold that contain silver, such as silver futures contracts or silver exchange-traded funds (ETFs).

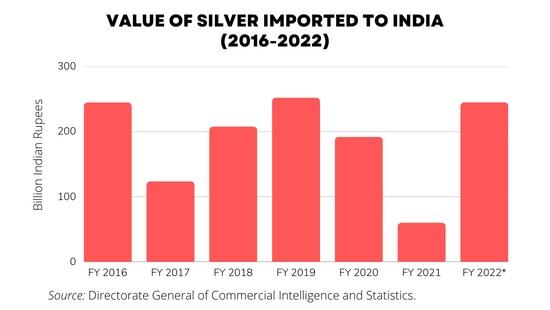

How much silver does India import?

According to the data released by Directorate General of Commercial Intelligence and Statistics, silver imports in India for the FY-2022 are estimated to be around ₹244.54 billion rupees. This is a substantial provisional rise of approximately 75.6% from the previous year which was merely ₹59.6 billion.

In terms of volume, India’s silver imports in 2020 and 2021 were 2,218 tonnes and 2,773 tonnes respectively, down from 5,969 tonnes in 2019.

The country fulfills most of its silver requirements through imports, mainly from United Kingdom, Hong Kong, Russia, and China.

| Year | Value of Silver imported (in billion Indian rupees) |

|---|---|

| FY 2016 | 244.40 |

| FY 2017 | 123.30 |

| FY 2018 | 207.25 |

| FY 2019 | 261.89 |

| FY 2020 | 191.62 |

| FY 2021 | 59.6 |

| FY 2022 | 244.54 |

| Source: DGCI&S; Department of Commerce (India) |

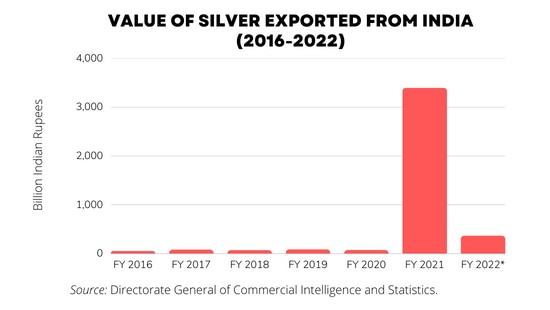

How much silver does India export?

According to the Department of Commerce, India’s silver exports fell drastically to just ₹363 billion in FY 2022 registering a fall of 89.29% against FY 2021. Considering the data of the last 8 years the export was relatively decent since from FY 2016 to FY 2020, the average value of exports was just ₹68 billion.

Silver exports from India reached as high as ₹3,393 billion in FY 2020. India exports silver majorly to the United Kingdom, USA, Germany and Italy.

| Year | Value of Silver imported (in billion Indian rupees) |

|---|---|

| FY2016 | 48 |

| FY2017 | 76 |

| FY2018 | 66 |

| FY2019 | 82 |

| FY2020 | 68 |

| FY2021 | 3393 |

| FY2022 | 363 |

| Source: DGCI&S; Department of Commerce (India) |

Which countries produce the highest quantities of silver?

In 2021, the total amount of silver that was mined increased by 5.3 percent, totaling around 23,323 tonnes. The recovery in output following the COVID-19-related disruption in 2020 was the primary cause of this gain, which was the most notable annual growth in the supply of mined silver since 2013.

Since primary silver mines are concentrated in nations where mining was severely impacted by COVID limitations in 2020, silver production from these mines increased by 10.2 percent.

Here is the list of top 11 silver producing countries of the world for the year 2021.

| Country | Production in tonnes (2021) | Share in global production |

|---|---|---|

| Mexico | 5576.98 | 23.91 |

| China | 3201.02 | 13.72 |

| Peru | 3059.26 | 13.12 |

| Australia | 1216.33 | 5.22 |

| Poland | 1190.81 | 5.11 |

| Bolivia | 1176.64 | 5.04 |

| Chile | 1168.13 | 5.01 |

| Russia | 1105.76 | 4.74 |

| United States | 921.46 | 3.95 |

| Argentina | 751.35 | 3.22 |

| India | 629.43 | 2.70 |

| Total Global production | 23322.94 | |

| Source: Silver Institute, World Silver Survey 2022 | ||